Addressing higher education economics: Policy analysis for tuition

Klevisa Kovaci

Abstract: Critical to a prosperous, democratic, and productive society, higher education provides significant benefits to individuals and communities. Initially an endeavor reserved for elites, pursuit of a college education gradually became accessible to the United States’ middle class because of government policies and laws instated in the 1800s and onward. Today, however, college tuition increases are outpacing both wage growth and inflation rates. This paper examines the problem of excessively high tuition in American higher education. It presents and assesses policy options to address this issue using supply- and demand-side economics. Research suggests that colleges that provide financial aid through grants and loans are more affordable for students, particularly students from lower socioeconomic backgrounds. Likewise, evidence suggests that income-targeted tuition may be an effective approach for directing tuition benefits to those with the highest need and may minimize economic inefficiencies. Other policy options, such as free tuition and increased competition, yield less consistent results. Policies should also consider the context of demand and supply for higher education, specific fields of study, and how they relate to the labor market.

Keywords: Higher education, U.S. education system

I. Introduction and background

Higher education’s dramatically increasing tuition costs pose social and economic issues for the U.S. High tuition obstructs access to college education, harms individual student health, and exacerbates an already looming debt crisis. These consequences are especially pronounced for students coming from traditionally marginalized backgrounds because they impede social mobility. In addition, uncertainty that an expensive degree will lead to a well-paying career without excessive student debt deters potential students. Evidence-based policy recommendations should seek to reduce the negative consequences of high college tuition in favor of more accessible higher education policies.

Various studies examine policies that may lower or control the high cost of tuition, either by targeting tuition directly (supply-side policies) or by providing financial assistance to students to reduce the tuition burden (demand-side policies). Policy options must also consider social equity and diversity in higher education. Evidence-based studies have major implications for policymaking, but they also face methodology limitations. Thus, policy discussions must consider evidence-based findings, their consistency, and their scalability in the context of higher education and labor markets.

History of higher education in the USA

Before the nineteenth century, higher education in the United States was only available to a few wealthy individuals. Throughout the nineteenth and twentieth centuries, federal laws substantially increased both the volume of colleges and universities and the number of students who attended them. In 1862, Congress established the Morrill Land Grant Act, which allocated land to U.S. states to sell for proceeds that states could use to establish new universities (Library of Congress 2017). Beginning In 1901, states established two-year community colleges (“junior colleges”), for technical and vocational training (Encyclopedia Britannica 2019). Additional targeted laws, such as the GI Bill of 1944 and financial assistance provisions in the 1970s, further increased students’ access to higher education. These laws diversified college applicant pools through inclusion of nontraditional groups at the time, such as veterans, women, and students from minority races and traditionally marginalized backgrounds. President John F. Kennedy's 1961 Executive Order 10925 created “affirmative action” to ban applicant discrimination and foster diversity in workplaces and universities (Hoxby 1997). In the midst of the 1960s civil rights movement, this move helped to drive forward equal rights and access to work and education for African Americans and other minorities.

The proliferation of universities and candidates drove competition among students – over gaining admission to top programs – and among schools – over attracting top applicants, talented faculty, and maximum funding (Bordelon 2012). Competition among universities gained momentum as applicants began to travel further from home to pursue higher education. Initially seen as local institutions serving local populations, universities grew into national economic entities for which students and faculty would be willing to move throughout the country. Simultaneously, changes in the economy and increasing demand for college-educated workers radically altered the higher education market. Tuition costs grew rapidly. In 2018, the average out-of-state tuition and fees at public universities rose by 2.4% to $26,290 and at private universities by 3.3% to $35,830 (see figure below). Beginning in the early 1980s, tuition rate hikes surpassed wages and inflation rate increases for all but the top income earners, making university disproportionately unaffordable for most (see figure below). From 1998 to 2008, tuition at four-year universities increased 4.1% beyond inflation, and from 2008 to 2019, it increased an additional 3.1% (The College Board 2018). As the higher education cost increase outpaces wage and inflation increases, it compromises access to college education and reduces its full benefits to society.

Theory: benefits of education and the role of policy

The value of education, particularly higher education, to society is profound in civic life and the economy. Individually, more schooling has “strong causal effects” on increased earnings, improved health, and healthy behaviors (Heckman et al. 2016). In the community, education breeds informed and engaged citizens, which boosts social cohesion and democracy. Moreover, obtaining a college degree enables people to pursue work opportunities that can improve their socioeconomic situations, thus lowering socioeconomic inequality (Edwards and Marin 2015). Post-secondary education, in particular, benefits minorities and traditionally marginalized groups because it provides a way to climb the economic ladder into desirable positions in the workplace. Affirmative action, for instance, improves representation of racial minorities, such as African Americans, Hispanics, and Native Americans. Investing in higher education is important for economic prosperity, social mobility, and equality because it affects cross-sectional and intergenerational income distribution (Abbott et al. 2016).

Additionally, through teaching workplace skills, higher education builds resilient individuals who can adapt to a constantly shifting and fluctuating market. Obtaining a college degree is a prerequisite for many professional fields in the United States In 2018, 63% of U.S. jobs required a diploma beyond high school (Bordelon 2012). Over the past three decades, the earnings premium from a college degree rose because of the increased value of college-educated workers (Oreopoulos and Petronijevic 2013). Heckman and colleagues agree that additional years of schooling generally correlate with higher earnings and increased productivity, which are key factors to a healthy economy (Heckman et al. 2016).

In addition, education reduces crime rates and produces social savings. In the United States, a one-percent increase in the high school completion rates of men between the ages of 20 and 60 correlates with savings of $1.4 billion per year in reduced crime-related costs (Lochner and Moretti 2004). This effect may be a result of the higher income associated with college graduates that causes highly educated individuals to have a higher opportunity cost (in the form of losing that income) if they engage in illicit behavior. Another theory is that schools may teach students to be more risk averse, which discourages them from engaging in illegal activities. The prohibitive cost of college tuition restricts access and thereby jeopardizes higher education’s full benefits to society and the economy. Costly higher education harms individual financial well-being, inclusivity, social mobility, and the United States’ economic health.

II. Developments and consequences of high tuition

Effects of high tuition

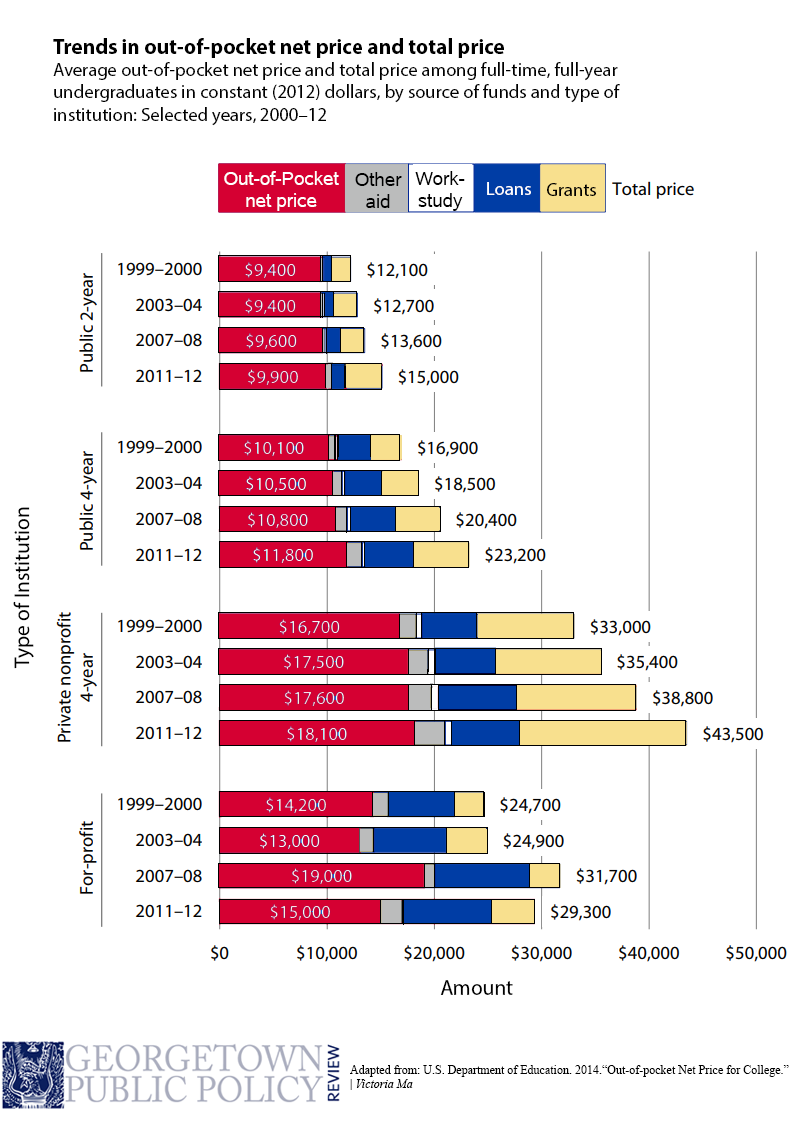

Rising college tuition costs cause tremendous financial strain for students. Between 1987 and 2010, collegiate institutions oversaw steep tuition increases (Gordon and Hedlund 2016). In 2015, students of four-year private universities paid an average of $18,000 per year out of pocket and financed the remainder of their tuitions ($25,000 on average) through grants and loans (see figure below). The high amount of student loans has perpetuated a debt crisis with ramifications for college students and graduates.

Drastic tuition hikes challenge the accessibility of higher education. A case study on public universities in California from 2008 to 2012 demonstrated a correlation between increased tuition, reduced state aid, and decreased enrollment at California public universities, with an 8% increase in students taking out college loans (Jackson and Warren 2018). Rosemont College also observed a drop in application and enrollment numbers due to increased tuition (Eldridge and Cawley 2017). In fact, the National Association of University Colleges and Business Officers (NACUBO) showed in a 2015 report that one-third of universities that increased tuition from 2010 to 2015 experienced flat or negative net tuition revenue (NACUBO 2016). In 2017, the same study showed that universities’ net revenue from tuition decreased by 0.1% that year. This figure is down from the 2.6% increase in 2016, and 8% increase since 2010 because tuition hikes forced universities to also increase financial aid, offsetting the revenue earned from higher prices (Ibid). Continuous tuition increases appear to lead to eventual stagnation, or even diminishing net revenue, and reduced enrollment at universities. In fact, about 50% of universities reporting data to NACUBO in 2015 stated that their enrollment had declined due to “price sensitivity” (Zinshteyn 2016). This threat poses efficiency questions, not only for students financing high tuition, but also for universities attempting to deliver quality education while maximizing their profits.

Socially, high tuition contributes to increased inequality and perpetuates social status quo. In a telling study, Zimmerman found that admission to elite higher education institutions raises the probability of a student attaining a company leadership position (i.e., director, manager) by 50% in Chile. As a result, college students from wealthy families – especially males who previously attended private high school – are best positioned to obtain jobs in top leadership roles with peers from similar backgrounds (Zimmerman 2019). A college education also increases this elite group’s chance of being in the top 0.1% of income distribution by 45%. If only wealthy families in a given society can afford to invest in an expensive college education, the cost becomes prohibitive for other parts of the population and helps sustain high income inequality. The United States exhibits similar features: costly university tuition, varying socioeconomic groups with different degrees of access to higher education, and school programs that help enable graduates to attain leadership posts. In the United States, exorbitant tuition costs are unaffordable for many who are not in the higher socioeconomic levels. Prohibitive tuition may hamper access to higher education and endanger upward mobility for poor youth who lack the financial means to pay. In the United States, already high tuition indebts youth, particularly those with scarce resources, reduces their purchasing power, and precipitates a debt crisis in the macro scale and long term.

Debt Consequences

Compounding the accessibility issue, federal financial aid expansion has been more sluggish than tuition increases. In response to the 2007 economic recession, most U.S. states cut financial aid for approximately five years (Mitchell and Leachman 2015). These cuts included slashing discretionary programs that fund higher education for low-income students due to large budget deficits. In 2017, the federal government budget eliminated the need-based Federal Supplemental Educational Opportunity Grant (FSEOG) (effective 2019) (U.S. Department of Education 2018), drastically reduced work-study amounts, and cut Pell Grants by $3.9 billion (White House 2017). Despite state government funding increases in 2016, the amount of aid offered per student was eight to 11% lower than it had been before the recession (The College Board 2018).

In addition to the reductions in quantity of government financial aid, the shifting composition of financial aid has made managing aid less sustainable for students. Post-2010, students have been taking out more unsubsidized loans, as the amount of government-subsidized loans offered has been slowly declining since 2010 (The College Board 2019). Interest rates for federal student loans have steadily increased since 2016 (Nova 2018). Meanwhile, some private colleges reduce institutional aid and use the net funding gain to finance education inputs, thus substituting some qualified poor students for less qualified wealthy students (Epple et al. 2013). This trade-off based on ability to pay especially harms socioeconomically disadvantaged students.

Overall, a societal emphasis on the importance of a college degree combined with exorbitant tuition prices has precipitated a student debt crisis in which the average U.S. student incurred $30,156 in debt in 2016 (Federal Reserve Board of Governors 2016). Among students who completed some post-secondary education, 41% acquired debt to fund their education in 2015, a figure which does not include those who also borrowed from family or friends (Ibid). Furthermore, one-third of students who borrowed money did not graduate (Council for Economic Education 2016). Students who borrow and leave programs particularly suffer from enormous direct and opportunity costs, especially if from poor backgrounds. They accumulate debt, but lack the degree to obtain higher-paying jobs, and so work in low-paying jobs to pay back the debt (Baumhardt and Hanford 2018). This is detrimental for the economy which experiences high debt, lower income productivity, and consequently lower tax revenue (Kolodner and Butrymowicz 2017). Some experts in higher education economics believe that these statistics may indicate a looming student debt bubble: At $1.5 trillion, student debt affects 44 million Americans and is among the largest debt categories in the United States, second only to home mortgage debt (Student Borrower Protection Center 2019).

Finally, the high cost of college may have negative health impacts on both students and borrowers. Approximately 70% of students surveyed in the Study on Collegiate Financial Wellness 2017 stated that they viewed finances as a “major stressor,” and many worried that they would not have enough money to afford school (Ohio State University 2017). Students also listed finances as an obstacle to graduating from college. These sentiments have been increasing for years; the 2013 American College Health Association National College Health Assessment showed that 35% of students in the United States reported that their finances were “traumatic or difficult to handle” in the last year (Adams-Gaston and Gordon 2017). Moreover, student debt prompts students to seek careers in the private sector, which tend to pay higher salaries than the often under-staffed professions that contribute to the public good, like public defense and social work (Bruinius 2017). Student loan debt can have additional long-term impacts on a graduate’s lifestyle and spending choices, such as postponing a home purchase or marriage due to debt. In order to address high tuition and its negative consequences, policymakers must understand its drivers. Various influences contribute to expensive tuition, including high demand for college education and underlying costs of university operations.

Causes of increased tuition

No clear consensus exists to explain the rapid increase in college tuition prices relative to wage growth in the United States. One argument asserts that the job market’s demand for college-educated workers has increased demand for higher education (Brady 2013). The increased demand for higher education allows universities to raise prices significantly because students remain willing to pay.

Another theory asserts that increases in the underlying costs of university operations have led to tuition increases. For example, individualized attention in classrooms has become a selling point for colleges as smaller class sizes have become a priority for the students they attempt to attract, but meeting that expectation requires universities to hire and pay more professors. Others believe that increased costs of additional spending on nonessential activities and staff beyond core academics and job preparation constitute economic inefficiency, such as significant sports, stadiums, enhanced dorms, optional social activities, and an excessive number of administrators (“Making college cost less” 2014). Economic models, like those of Gordon and Hedlund and the New York Federal Reserve Bank, find that tuition subsidies through financial aid and Federal Student Loan Programs are somewhat responsible for tuition increases (Gordon and Hedlund 2016). Section four elaborates upon that theory.

A general theme of the theories surrounding tuition increase is that it is likely a product of higher education “marketization,” a phenomenon in which universities increase their number of administrators, raise tuition, and focus on auxiliary activities, like sports and recreation, to attract more applicants (Ibid). Under pressure to maximize profit by cutting budgets and generating revenue, university deans prioritize recruiting faculty and staff, fundraising, and creating programs to attract more applicants over moderating the cost of enrollment (McClure and Teitelbaum 2016). Therefore, tuition increases may be symptomatic of the broader phenomenon of marketization and market forces in higher education, and its true cause is likely a combination of the above theories and others. Indeed, policymakers and university administrators must consider the causes of increased tuition not only within the context of the higher education market, but also in its interplay with the labor market, as the two are closely linked. The greater the price of a diploma, the more imperative it becomes for the diploma to yield higher return on investment for graduates through future earnings.

Additional consideration: return on investment of an expensive degree

College attendance is an integral component of social mobility because it facilitates a higher lifetime earning potential. In the 1980s, college graduate salaries began to exceed the salaries of those with high school diplomas at an increasing rate (see figure below). In recent years, however, the wage gap between workers with high school and college diplomas has stagnated, and the highest salaries are reserved for those who hold master’s or professional degrees. The job market’s increased demand for graduate-educated employees diminishes the value of a college degree. In some professional markets, a college degree will no longer suffice (Valletta 2016).

Increasingly, college graduates are underemployed or working in fields unrelated to their collegiate studies. A McKinsey report noted that 48% of recent college graduates are in jobs that do not require a four-year college education; almost half of all U.S. college graduates could not find jobs in their chosen field (Voice of the graduate 2013). These figures signal that, despite the exorbitant fees college students pay for education, the employment outcomes they face are increasingly disappointing. In fact, a PayScale study showed that, while some graduates earn very high premiums from a college degree, others are worse off from going to college. For instance, a computer science graduate from Stanford can make $1.7 million more in 20 years than a graduate of high school only. At the same time, an arts and English student from a less known school would be $132,000 worse off in 20 years than someone who only graduated from high school (PayScale 2018). The PayScale study estimated that Arts degrees from 12% of colleges actually yield negative returns (“Making College Cost Less” 2014). Financially, some such students might be better off if they had begun working at age 18 instead of attending college. Opportunity costs are especially high for liberal arts students, who typically obtain lower paying jobs immediately after graduating from college than students graduating from professional degree programs (Scott 2018).

Even graduates of highly technical and targeted programs may face a saturated job market and may have to accept employment outside their fields of expertise (Larson et al. 2015). Market saturation makes higher education a risky and competitive endeavor without a guaranteed return on investment. Lower, more affordable tuition would ensure that higher education would be a worthy endeavor with a positive return on an investment. The most direct way to control the tuition is through policies that directly influence tuition levels to keep them low, especially for those who can least afford it.

III. Supply-side policies: controlling tuition

Supply-side policy recommendations to control tuition are policies that directly determine or influence the price or quantity of higher education. These policies would dictate tuition levels. They range between offering the same tuition for all (horizontal equitability) to targeted tuition levels, where each student pays an amount corresponding to his or her level of household income (vertical equitability).

Free vs. income-targeted tuition

Free tuition movements and programs are popular answers to the tuition crisis in the United States and globally. These constitute horizontal equitability as everyone benefits from free higher education. Examples of such movements include Michigan’s 2005 Kalamazoo Promise program, the 2014 Tennessee Promise, City of Chicago programs for free community college, Senator Bernie Sanders’ 2015 proposal for free college, the founding of the Campaign for Free College in 2014, a 2013 Chilean student movement, the South African #FeesMustFall movement in 2016, and a 2017 Philippines decision to abolish tuition (de Gayardon 2017).

Experts warn, however, that government-funded tuition is extremely expensive and may have unintended consequences. Free tuition is not targeted, meaning it treats all students equally regardless of their abilities to pay and income levels. While egalitarian, the policy can bolster social inequity and economic inefficiency by providing a free service to individuals who are willing and able to afford tuition. Instead, taxpayers would collectively shoulder the burden of funding free college for students at a rate that amounts to approximately 1.5% of the US GDP (Usher 2017). In Quebec, a proposed “free tuition” plan lawmakers are considering would cost taxpayers $1.1 billion per year, and the cost would rise to $1.3 billion if extended to other Canadian and foreign students in the province (Moreau 2018). Usher notes that “free tuition may be wasteful in that it provides subsidies to those who would likely attend regardless” (Usher 2017). Economically, this proposal introduces inefficiency because it taxes the general population and partially subsidizes individuals who are willing to pay the full price of college tuitions without the subsidy.

A more targeted approach, only offering free tuition to the poorest students, presents a more elegant option for controlling tuition costs without dramatically sacrificing economic efficiency, though increased complexity always detracts from efficiency to some degree. Such a policy maintains the same tuition levels for all but subsidizes only those with the lowest incomes so that they can afford the tuition. Enacted in 2017, New York’s Excelsior Scholarship provides tuition-free public college education to New York students with annual family incomes lower than $125,000. In 2018, 3% of all undergraduate students in New York received this award, while 70% of applicants were rejected because they did not meet the program criteria (Center for Urban Future 2018). The scholarship, targeted towards low- and middle-income students, may be successful in that all offers went to students with family incomes under $125,000. However, some argue that its threshold is too high. To have its intended effect, a targeted approach must carefully identify an appropriate income threshold. If the income threshold is too high, it poses the same efficiency risks as a free tuition system.

A more progressive proposal, income-targeted tuition, would assign different tuition levels based on individuals’ family incomes (Usher 2018). This approach is targeted to assist those with the highest need, and it facilitates differentiation between students with varying financial means. However, it assumes that students’ families would be willing to support students and raises questions about the fairness of charging different prices for the same good. It may also be more challenging to manage and implement due to customizing tuition for each student. Customizing and implementing different tuition amounts for each student is administratively costly with downsides for efficiency. Additionally, addressing the fundamental problem of excessively high tuition may require a more dramatic step to lower the cost entirely. Therefore, some universities have selected to drop tuition significantly and immediately to achieve greater affordability for all students, without sacrificing the economic efficiencies of high tuition.

Tuition Reset

Tuition reset is a dramatic proposal involving intentionally drastic tuition reductions. In 2016, Rosemont College sampled this approach and reduced its tuition by 43%, dropping tuition from $32,620 to $18,500 in 2015 (Eldridge and Cawley 2017). It dropped room and board from $13,400 to $11,500. As a result, applications increased 64%. Enrollment of students from “squeezed” middle-income families increased by 60%, while representation from different countries also increased. Citing university data and policy research, administrators Eldridge and Cawley of Rosemont College explained that university administrators “were left uneasy by a model in which tuition is artificially inflated and then matched with ‘discounts’ offered in the form of grants and scholarships. We understood that this was not real money” (Ibid).

A tuition reset may be ideal, but it is uncertain that universities will drastically reduce prices. Mainly, universities still perceive this move as risky because they may forgo revenue that high tuition generates, while enrollment may not increase by enough to offset the lower tuition price. Extremely competitive universities that enjoy high demand from applicants at all times, regardless of tuition level, may not view tuition discounting as necessary. Indeed, the universities experimenting with tuition reset tend to be smaller colleges that have faced financial challenges, such as Birmingham-Southern, Drew, Mills, and Sweet Briar College (Vedder 2018). Beginning in 2018, more universities are engaging in tuition reset, although the number is still small (Moody 2018). Instead, most universities and governments (federal and state) are turning to common demand-side policies to render tuition affordable for students by providing them with financial aid.

IV. Demand-side policies: financing students’ costs

Demand-side policy proposals subsidize tuition costs to improve students’ abilities to afford higher education. Instead of altering the price and availability of education, demand-side policies deliver funding to buyers to supplement higher education, such as through grants and loans.

Financial aid through grants

Reform proposals often recommend using grants as a primary form of financial aid to address high tuition cost. The government can deliver grants through need-based aid, work-study programs, and fellowships. In the United States, 75% of full-time students receive some form of grant-based financial aid to help pay for college (The College Board 2018). Research suggests that grant aid has a positive correlation with racial and economic diversity in colleges and universities (Abbott et al. 2016). It is also correlated with economic welfare and higher GDP: researchers estimate that removing college federal aid, grants and loans, would reduce economic output by 2% and welfare by 3% in the long term (Ibid).

Need-based aid and scholarships often yield better student outcomes than loans or no financial aid at all. Students receiving need-based grants perform “significantly better” in college than those not receiving financial aid (Cappelli and Won 2016). A one-third increase in federal aid increases college attendance by 6%; poorer students in the second, third, and fourth income deciles comprise most of the increase (Eppel et al. 2013). Reductions in federal or state aid cause the most drastic enrollment rate drops among students from traditionally marginalized communities.

College accessibility and enrollment challenges facing traditionally marginalized communities is a recurring trend. For example, Mexican-born non-citizen youth (including undocumented youth) residing in states that require all non-citizens to pay out-of-state tuition are 12.1% less likely to enroll in college than their peers living in states without tuition discrimination (Bozick et al. 2018). As this discussion indicates, studies consistently show that affordable tuition and sufficient financial aid reduces inequality.

Some evidence suggests that high-risk groups, such as “at-risk youth” also benefit from lowered tuition and financial aid in college. In 2001, the federal government amended the Higher Education Act to ban people convicted of drug offenses from receiving federal financial aid for two years after conviction (Lovenheim and Owens 2013). Combining data on educational outcomes and drug charges, Lovenheim and Owens show that the 2001 ban on financial aid delayed previously convicted citizens’ college enrollment by at least two years and decreased the likelihood that they would enroll in college at all. The amendment had its most significant impact on first-generation students from urban areas (Ibid).

Nevertheless, there is a limit to the positive impact financial aid provides. On average, every additional dollar of a government grant replaces 20-30 cents that students or their families would have otherwise provided (Abbott et al. 2013). In addition, every dollar of government aid reduces the number of hours that a college student works by 4% (Ibid). Thus, if overused, tuition grants can contribute to economic inefficiency by substituting family contributions and work hours.

Paradoxically, tuition increase may be an unintended consequence of excessive financial aid that is not appropriately targeted. Sengenberger believes that “student debt is not just rising because college is too expensive. Rather, school is too expensive because of rising student loans and grants” (Sengenberger 2017). Financial aid, including through loans, shields students from immediately paying the full cost of tuition and allows them to pursue expensive degrees. Low-income students, in particular, suffer most if their financial aid options are loans.

To address this, Sengenberger proposes providing students with stipends or vouchers instead of loans to make tuition affordable while still exposing students directly to the actual tuition cost. This way, students would be charged the full amount of tuition, while possessing the means to afford the tuition directly, thereby making more educated decisions on which school to attend and how to finance their education. Student stipend or vouchers differ from traditional financial aid in that students would receive stipends or vouchers straight from the government and decide which university to attend using the stipend. Conversely, the current financial aid system awards grants to universities to disburse to enrolled or accepted students.

While rare, an example of such a system is the Colorado College Opportunity Fund, enacted in 2004 after the state was no longer able to support high financial allocation to higher education. The system substituted previous financial aid with a $2,400 voucher ($80 per credit hour) to each student attending a public university in Colorado. A journal study conducted 10 years later found that this system had created some cost efficiency in community colleges but reduced college access for some underrepresented groups since it reduced other forms of government aid simultaneously (Hillman et al. 2014). Beyond this, the theory of using vouchers and stipends in higher education has not been tested thoroughly and requires more research to determine its effects.

Overall, the evidence summarized above supports a consensus among most higher education economics researchers, the U.S. Department of Education, and university administrators that the government should allocate tuition aid based on financial means and prioritize delivering assistance to students from lower socioeconomic rank in order to expand higher education opportunities to those least able to afford it. Expanding need-based financial aid would increase the number of qualified students from a wide variety of socioeconomic backgrounds. However, financial aid in the form of grants is very costly to governments and universities, and alone usually does not suffice to cover full tuition amounts, which is why governments, universities and private companies offer loans to help students obtain the means to pay for college.

Loans and Repayment Programs

Though they pose more challenges for the students who depend on them than grants, loans are an essential reality of funding a college education for many young adults. In 2016, 59% of undergraduates who borrowed money to pay for college graduated with an average of $28,500 in debt, a 3% increase from 2011 (The College Board 2018). Yet, studies conclusively show that, as in the case of grants, loans reduce family and individual contributions, and indirectly cause tuition to increase. Abbott finds that each additional loan dollar reduces parental contribution by 30 cents (Abbott et al. 2013). The Federal Reserve Bank determined that tuition increases 60 cents for each dollar received as subsidized loan and 20 cents for a dollar received as an unsubsidized loan (Lucca et al. 2017). Therefore, like grants, the amount of loans distributed must not exceed families’ abilities to pay for tuition, or else risk offsetting student contribution.

Research on loans and student outcomes is not conclusive. Some studies have shown that loans have little effect on college retention, while others indicate that loans have differing effects on the retention of students from different socioeconomic groups (Heller 2008). Capelli and Won argue that students who took out loans scored 0.6 to 0.12 points lower on a 4.0 GPA scale than students who received financial aid other than loans (Capelli and Won 2016). Similarly, Stoddard and Schmeiser show a correlation between high loan balances and lower GPA, lower retention rate, and students taking fewer courses (Stoddard et al. 2018). On the other hand, Third Way demonstrates that those who take out student loans up to $20,000 are more likely to graduate than their peers who do not take out student loans, and that the graduation rates are highest for those who assume up to $10,000 in debt (Dwyer 2018). For some students who need loans, a certain level of loans can act as incentives to graduate and seek employment to repay them.

In order to meet the rising need for higher education financing, the U.S. government enacted loan repayment plans with different terms based upon income levels. These include the Income-Contingent Repayment Plan (ICR Plan) enacted in 1994, the Income-Based Repayment Plan (IBR Plan) enacted in 2007, the Pay As You Earn Repayment Plan (PAYE Plan) created in 2010, and a Revised Pay As You Earn Repayment Plan (REPAYE Plan) developed in 2015. Public Service Loan Forgiveness, which the government runs through the College Cost Reduction and Access Act of 2007, eliminates loan balances for borrowers who work in public service careers after graduation and make 120 payments (Federal Student Aid 2019). Practices like forbearance and deferment allow debtors to temporarily suspend loan repayment if experiencing difficulties or extraneous circumstances (Ibid). In forbearance, interest that debtors have to pay continues to accumulate. In deferment, interest also accumulates, but the government pays the accumulating interest of subsidized loans.

Enormous amounts of student loan debt raise legitimate questions about the practicality of financing college. At $1.5 trillion, the high amount of debt may constitute a crisis; the Brookings Institution estimates that by 2023, almost 40% of student loan debtors will default (Scott-Clayton 2018). After 2007, the composition of household debt changed so that mortgage debt fell from 73 to 67% and student debt rose from 3% to over 10% of total household debt (Cangero 2017). A high default rate for student loans is therefore dangerous. This is especially the case for minority groups, which have higher default rates. The default rate for African Americans, for instance, is five times higher than for Caucasian borrowers (Ibid). Moreover, high student loans reduce the purchasing power of the borrower, and consequently their spending, thereby causing a “drag” on the economy and GDP, which Farrington estimates to be a loss of 1-2% of GDP in the long run (Farrington 2018).

Currently, 29% of federal borrowers repay their loans through repayment plans. As of 2019, one out of four borrowers are behind on their student loans (Student Borrower Protection Center 2019). More troubling, 17% of borrowers have defaulted on their student loans (The College Board 2018). Fifteen percent default within three years of beginning payments (“Making college cost less” 2014). To put it in perspective, the student loan delinquency rate (rate of late payments in 2017) was 9.2%, higher than that of mortgages (under 2%), credit cards (5.1%), and auto loans (2.3%) (Cangero 2017). Even people who qualify for public loan forgiveness often encounter barriers to accessing it. In 2018, the Education Department approved only about 1% of over 28,000 applications for loan forgiveness under the program (Federal Student Aid 2018). This outcome is due to the fact that some borrowers did not meet the requirements because requirements were unclear. The United States Government Accountability Office Report on Public Service Loan Forgiveness found that the program and its policies are “fragmented,” complex, not administered effectively, and lacking in clear communication to participating employers and borrowers (United States Government Accountability Office 2018). Nonprofit organizations investigating the matter also believe that the student loan industry has also unduly delayed, deferred or denied access to expected debt relief (for example, the American Federation of Teachers is leading a lawsuit against Navient, a company that allegedly misled borrowers about the public service program in order to keep them from transferring to FedLoan).

Testimonials from qualifying debtors indicate that significant challenges in comprehending and adhering to complex policies and information made using of the Public Loan Forgiveness Program difficult (Tompor 2017). As such, loan repayment and forgiveness programs must be administered clearly, making borrowers aware of loan programs, terms, and procedures in simplistic yet informative terms.

Finally, most borrowers do not qualify for loan forgiveness programs or loan cancellation. Thus, most student debtors often continue to pay loans for decades, enduring a loss of income and reduced ability to purchase other goods and services in the long term. Though student loans make obtaining a college education possible for millions of students who would otherwise be unable to attend, they saddle students with financial burdens that tend to last much longer than two or four years. As such, taking on loans is a crucial decision for students, who must understand the implications of taking out loans and how to manage their finances to make loan repayment sustainable.

Comprehensive Financial Wellness

Scholars and practitioners agree that financial wellness training is an effective way to help students manage their debt and tuition costs. In 1992, the U.S. government enacted its first student loan entrance counseling and has continued to adapt it in conjunction with its various borrowing programs since. Nevertheless, in 2017, only 50% of students surveyed felt that counseling increased their understanding of the terms of their loans (Adams-Gaston and Gordon 2017). Further, American students score relatively poorly in financial literacy compared to their counterparts in other OECD countries and are less knowledgeable about financial management and loan borrowing (Farrington 2014). A 2016 Money Matters report found a decline in responsible financial behaviors among students (EverFi 2016).

For these reasons, scholars and practitioners recommend comprehensive financial wellness training and workshops for credit and loan management beyond the required, cursory government loan counseling (Ibid). Increasingly, U.S. universities offer school-wide initiatives to educate students on financial literacy and wellness. Financial wellness encompasses all aspects of a person’s financial situation, including financial awareness, goal setting, and achieving financial goals (Montalto et al. 2018). Recently, Indiana University illustrated that combining financial aid with financial wellness training yields positive results for students. After the University disbursed more than $1.1 billion in financial aid between 2011 and 2016, 45% of its students graduated without loan debt in contrast to the 30% of students who did so nationally. Eighty percent of Indiana University students who graduated with loans had loan balances below the national average. The University’s generous financial aid and its financial wellness training reduced student borrowing by almost $100 million (Wilkins 2017). In the case of Indiana University, university policies mandating financial disclosures and financial literacy education produced positive results in educating students in financial wellness and their loan conditions. These types of policies may be adopted by other universities to educate and empower a financially literate student body to make beneficial financial decisions in regard to loan borrowing and related financial behaviors.

V. Other market-based policies for consideration

Other policy options to make college more affordable would make use of market forces to reduce the college tuitions. Proposals include lowering barriers to entry so that more universities offer education, and deregulating tuition decisions at public universities.

Competition

Exposing the higher education market, including for-profit universities, to increased competition is a common policy proposal aiming to reduce college tuition. Increased competition would lower tuition prices as universities vie for students’ business (Brady 2013). Reforming the university accreditation process, which acts as a gatekeeper to the establishment of new universities, is a means of increasing competition. University accreditation institutions grant accreditation status and control access to federal funding for colleges (Sengenberger 2017). An inherent conflict of interest often arises because these organizations’ staff is usually comprised of existing universities’ faculty and staff who may have an incentive to block competition (Hegji 2017).

Increasing the number of universities by lowering barriers to entry follows economic theory, but more studies need to be conducted to demonstrate this in practice. The substantial tuition increases that accompanied the proliferation of universities throughout the 1990s and 2000s threaten the validity of this theory. Furthermore, new universities – especially for-profit universities – often lag behind established universities in terms of branding, name recognition, and perceived prestige. New universities face challenges in competing against older universities due to the first-move advantage phenomenon, in which older universities that enter the market first obtain advantages through exercising leadership in higher education, capturing more market share first, and enjoying brand recognition and loyalty due to longer history and an older alumni base.

The lack of competition between for-profit and nonprofit universities also stems from the fact that the two occupy different niches in the higher education market and cater to different types of students. Generally, for-profit universities attract older, non-traditional students who aim to improve skills through a flexible study schedule (Liu 2011). Therefore, for-profit “competition” actually appears to complement, rather than substitute, non-profit universities.

Furthermore, for-profit colleges and universities may lead to tuition costs that are even more excessive, and total privatization of higher education may increase equity issues. In 2012, the U.S. Senate issued a report showing that half of students enrolled in for-profit universities dropped out without degrees, that for-profit universities used aggressive recruiting and marketing strategies, and that 96% of students took out loans (accounting for 47% of all student loans, even though enrollment at for-profit universities makes up 13% of all students) (U.S. Senate 2012). Furthermore, a National Bureau of Economics Research Report calls into question the return of investment in a for-profit university education by showing that graduates of such universities are 1.5 percentage points less likely to be employed and have 11% lower wages after receiving their diploma, compared to public university attendees (Cellini et al. 2011).

Tuition Deregulation in Public Colleges

Another policy option for addressing college tuition hikes involves deregulation of public university tuition decisions. This policy’s argument is that allowing public universities to set their own prices, as opposed to subjecting them to government-dictated prices, enables universities to collect enough revenue needed for operations, to rely less on government funding, and to allocate financial aid more efficiently. In 2003, public universities in Texas shifted tuition-deciding power from state legislatures to university administrators, which resulted in both increased tuition and increased grant financial aid for students from low-income households. As a result, poorer students switched to more expensive, but high-return majors and received financial aid for it (Andrews and Strange 2016). Before this shift, low-income students were underrepresented in lucrative majors because they cost more. Following deregulation, universities shifted more financial aid towards these students and helped them afford more lucrative and expensive degrees.

However, from 2003 to 2014, tuition in Texas had increased by 104% (not inflation-adjusted), a number greater than the national average, leaving students and families struggling to afford it and prompting Texas legislators to debate additional solutions to address high tuition (Schneider 2015). A study found that, after deregulation in Texas, enrollment of Hispanic students decreased by 9% (Flores and Shepherd 2014). Similarly, when Quebec deregulated international tuition for several McGill University programs in 2008, the overall tuition for those deregulated programs increased to $37,054 while the tuition for the regulated programs remained at $18,258 (Stanwood 2016). There are not enough sample cases upon which experts can predict the outcomes of deregulated tuition. The few existing cases, however, indicate that this policy may create unintended consequences, including increased tuition and heightened inequality. Overall, there is no other clear evidence that tuition deregulation of public universities will lead to better outcomes for students.

Shifting economy and markets

Unfortunately, college outcomes are somewhat subject to the whims of a fluid economy and financial markets. Effective policies governing tuition prices can boost, but not control, the ultimate value of a college degree. If a weak economy hampers job prospects for recent graduates, reducing tuition will help students to afford education, but it will not assist them well in realizing a high return on investment in the labor market because they cannot expect increased earnings. Additionally, if the market for college graduates is saturated and less demand exists for workers with diplomas from particular fields of study, then the lower return on investment for those degrees is a function of broader economic trends, structure, and climate. In recessions or poor economic climates where the market for four-year college degrees is saturated, policies should incentivize students to pursue trade school or community college to meet increasing demand for workers with such skills. This policy choice would help the economy meet demand for workers with four-year and two-year degrees beyond high school. In theory, a shift away from four-year colleges may also reduce tuition at those schools.

These considerations are beyond the scope of this article. As policies and economic phenomena are interlinked, researchers and policy makers must also study the related aspects of the market for higher education (supply, demand, price, and their qualities) and policy effects on them. Further studies must consider tuition in the broader context of higher education, skills, and labor force today.

VI. Conclusion

Critical to a prosperous, democratic, and productive society, higher education provides significant benefits to individuals and communities. Initially an endeavor reserved for elites, pursuit of a college education gradually became accessible to the United States’ middle class because of government policies and laws. These include laws in the 1800s to increase the number of universities, in the 1900s to support the founding of two-year universities, and in the mid-1900s to support inclusion of marginalized people. Today, however, college tuition increases outpace both wage growth and inflation rates. Among other factors, an overabundance of college graduates and increasing administrative costs contribute to the problem.

The trend of rapidly increasing tuition threatens accessibility of higher education for students from traditionally marginalized backgrounds. Consequently, in the short term, excessively high tuition stresses college students and graduates, places into doubt the return on their college degree investment, and causes them to delay significant life decisions. Macroeconomic effects of unaffordable tuition include a looming student debt crisis, weakened economy, and reduced socioeconomic mobility. Several policy options with varying degrees of support can address high tuition. Using supply-side policy proposals, universities may consider income-targeted tuition. While more administratively costly, income-targeted tuition would avoid the enormous expense of free tuition and economic inefficiency if the targeted levels are set at appropriate thresholds.

Another effective method to make college affordable and produce economic benefits is to provide students with grants or need-based financial aid. However, policy makers must be careful not to provide more aid then needed or risk offsetting the financing that students could have provided by themselves. The use of loans should be supplemented with financial wellness training so that students better understand and manage their debt. The U.S. government should also ensure appropriate, clear provision and management of loan repayment and forgiveness programs. Other policy recommendations to make higher education more affordable exploit market forces but are more controversial, such as deregulation of tuition decisions in public universities, reducing barriers to entry, and increasing the number of for-profit universities.

Ultimately, policy makers and university administrators will have to consider policies to control tuition in the context of shifting education and labor markets. While some policies demonstrate greater success than others in making tuition more affordable, many studies face the challenges of external validity. As such, policy makers and administrators need to tailor policies and approaches to particular types of universities, regions, or fields of study. It is clear that more research and evidence on higher education costs must inform any bold policy recommendations. A comprehensive menu of effective and impactful policies must ultimately render the price of higher education in the United States more affordable and accessible for young people in order to contribute to a thriving and equitable society.

+ Author biography

Klevisa Kovaçi is an international development consultant, with project engagements in Eastern Europe and Asia through the UN Kosovo Team, Permanent Mission of Albania to the UN, Dartmouth College, and non-governmental organizations. She holds a Master of International Affairs from Columbia University and Sciences Po (l'Institut d'Études Politiques de Paris).

+ References

Abbott, Brant, Giovanni Gallipoli, Costas Meghir, and Giovanni L. Violante. 2016. “Education Policy and Intergenerational Transfers in Equilibrium.” The National Bureau of Economic Research. http://www.econ.nyu.edu/user/violante/Workingpapers/AGMV_rev_v13_GV_CM.pdf.

Adams-Gaston, Javaune and Stephanie Gordon. 2017. “Financial Wellness for a Lifetime: Educating Students on Money Management.” NASPA Leadership Exchange. Page 27. http://www.thecb.state.tx.us/reports/PDF/9260.PDF.

Andrews, Rodney and Kevin Stange. 2016. “Price Regulation, Price Discrimination, and Equality of Opportunity in Higher Education: Evidence from Texas.” The National Bureau of Economic Research. doi:10.3386/w22901.

Baumhardt, Alex and Emily Hanford. 2018. Overwhelmed by student debt, many low-income students drop out.” APMreports. https://www.apmreports.org/story/2018/02/12/student-debt-low-income-drop-out.

Bordelon, Deborah E. “Where Have We Been? Where Are We Going? The Evolution of American Higher Education.” Procedia – Social and Behavioral Sciences 55 (2012): 101. doi: 10.1016/j.sbspro.2012.09.483.

Bound, John, Murat Demirci, Gaurav Khanna, and Sarah Turner. 2015. “Finishing Degrees and Finding Jobs: U.S. Higher Education and the Flow of Foreign IT Workers.” Innovation Policy and the Economy 15, 1: 27-72. doi:10.1086/680059.

Bozick, Robert, Trey Miller, and Matheu Kaneshiro. 2018. “Non-Citizen Mexican Youth in US Higher Education: A Closer Look at the Relationship between State Tuition Policies and College Enrollment.” International Migration Review 50, 4. doi: https://doi.org/10.1111/imre.12167.

Brady, Henry. 2013. “Let’s Not Railroad American Higher Education!” University of California, Berkley, Center for Studies in Higher Education: 96. doi:10.1017/S104909651200159X. https://gspp.berkeley.edu/assets/uploads/page/Lets_Not_Railroad_American_Higher_Education.pdf.

Bruinius, Harry. 2017. “Would axing a loan-forgiveness program narrow options for graduates?” The Christian Science Monitor (Boston, MA), May 24, 2017.

Cangero, Theodore. 2017. “Delinquency Rates Rise For Student Loans, Credit Cards, and Auto Loans,” American Institute for Economic Research. https://www.aier.org/article/delinquency-rates-rise-student-loans-credit-cards-and-auto-loans.

Cappelli, Peter and Shinjae Won. 2016. “How You Pay Affects How You Do: Financial Aid Type and Student Performance in College.” NBER Working Paper No. 22604. http://www.nber.org/papers/w22604.

Cellini, Stephanie Riegg and Nicholas Turner. 2018. “Gainfully Employed? Assessing the Employment and Earnings of For-Profit College Students Using Administrative Data.” National Bureau of Economics Research. https://www.nber.org/papers/w22287.

Center for an Urban Future. 2018. “Excelsior Scholarship Serving Very Few New York Students.” https://nycfuture.org/research/excelsior-scholarship.

Carlson, Scott. 2018. “Over Time, Humanities Grades Close the Pay Gap with Professional Peers.” The Chronicle of Higher Education. https://www.chronicle.com/article/Over-Time-Humanities-Grads/242461.

Council for Economic Education. 2016. “Current United States Student Loan Debt,” Survey of the States. http://www.surveyofthestates.com/#debt.

Cooper, Preston. 2016. “Many Accreditors Have Conflicts Of Interest,” Forbes. https://www.forbes.com/sites/prestoncooper2/2016/11/18/the-double-lives-of-higher-educations-watchdogs/#de1290661a72.

de Gayardon, Ariane. 2017. “Free Higher Education: Mistaking Equality and Equity,” International Higher Education 92: 13. https://ejournals.bc.edu/ojs/index.php/ihe/article/viewFile/10127/8824.

Dwyer, Rachel E. 2018. “Student Loans and Graduation from American Universities.” Third Way: 10-11. https://thirdway.imgix.net/downloads/student-loans-and-graduation-from-american-universities/Third_Way_NEXT_-_Student_Loans_and_Graduation.pdf.

Edwards, Sebastian and Alvaro Garcia Marin. 2015. “Constitutional rights and education: An international comparative study.” Journal of Comparative Economics 43, 4: 938-955.

Eldridge, Randy and Deborah Cawley. 2017. “The Mechanics of a Tuition Reset,” Planning for Higher Education Journal 45 3: 110. https://www.questia.com/library/journal/1G1-503275425/beyond-the-headlines-the-mechanics-of-a-tuition-reset.

Eldridge, Randy and Deborah Cawley. 2017. “Beyond the Headlines: The Mechanics of a Tuition Reset.” Planning for Higher Education Journal 45, 3: 110-119.

Encyclopedia Britannica. 2019. “Junior College.” https://www.britannica.com/topic/junior-college.

Epple, Dennis, Richard Romano, Sinan Sarpça, and Holger Sieg. 2013. “The U.S. Market for Higher Education: A General Equilibrium Analysis of State and Private Colleges and Public Funding Policies.” The National Bureau of Economic Research.

EverFi. 2016. Money Matters on Campus: Examining Financial Attitudes and Behaviors of Two-Year and Four-Year College Students. Lumina Foundation. https://www.luminafoundation.org/files/resources/money-matters-on-campus.pdf.

Farrington, Robert. 2014. “The Financial Literacy Gap Costs College Graduates Thousands Education.” Forbes. https://www.forbes.com/sites/robertfarrington/2014/07/16/the-financial-literacy-gap-costs-college-graduates-thousands/#8f36a814fb29.

Farrington, Robert. 2018. “Why the Student Loan Bubble Won't Burst,” Forbes. https://www.forbes.com/sites/robertfarrington/2018/12/12/student-loan-bubble-wont-burst/#1ce8d3636768.

Federal Reserve Board of Governors. 2016. “Education Debt and Student Loans.” Report on the Economic Well-Being of U.S. Households in 2015. Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/econresdata/2016-economic-well-being-of-us-households-in-2015-education-debt-student-loans.htm.

Federal Student Aid. 2018. “Federal Student Aid Posts New Reports to FSA Data Center.” U.S. Department of State. https://ifap.ed.gov/eannouncements/091918FSAPostsNewReportstoFSADataCenter.html.

Federal Student Aid. 2019. “Deferment and Forbearance.” U.S. Department of Education. https://studentaid.ed.gov/sa/repay-loans/deferment-forbearance.

Federal Student Aid. 2019. “Interest Rates and Fees.” U.S. Department of Education. https://studentaid.ed.gov/sa/types/loans/interest-rates.

Federal Student Aid. 2019. “Repayment Plans,” U.S. Department of Education.https://studentaid.ed.gov/sa/repay-loans/understand/plans.

Flores, Stella M. and Justin C. Shepherd. 2014. "Pricing Out the Disadvantaged? The Effect of Tuition Deregulation in Texas Public Four-Year Institutions." The Annals of the American Academy of Political and Social Science 655: 99-122. http://www.jstor.org/stable/24541752.

Gordon, Gray and Aaron Hedlund. 2016. “Accounting for the Rise in College Tuition.” The National Bureau of Economic Research. http://www.nber.org/papers/w21967.

Heckman, James J., John Eric Humphries, and Gregory Veramendi. 2016. “The Causal Effects of Education on Earnings, Health, and Smoking.” The National Bureau of Economic Research. http://www.nber.org/papers/w22291.

Hegji, Alexandra. 2017. “An Overview of Accreditation of Higher Education in the United States. Congressional Research Service. https://fas.org/sgp/crs/misc/R43826.pdf.

Heller, Donald. 2008. “The Impact of Student Loans on College Access.” The Effectiveness of Student Aid Policies: What the Research Tells Us. The College Board, 44 – 49. http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.171.649&rep=rep1&type=pdf#page=45.

Hillman, Nicholas W., David A. Tandberg, and Jacob P. K. Gross. 2014. “Market-Based Higher Education: Does Colorado’s Voucher Model Improve Higher Education Access and Efficiency?.” Research in Higher Education 55, 6: 601-625. doi:10.1007/s11162-013-9326-3.

Hoxby, Caroline M. 1997. “How the Changing Market Structure of U.S. Higher Education Explains College Tuition.” The National Bureau of Economic Research. http://www.nber.org/papers/w6323.

Jackson, Jacob and Paul Warren. 2018. California’s Tuition Policy for Higher Education: The Impact of Tuition Increases on Affordability, Access, and Quality. Public Policy Institute of California. https://www.ppic.org/wp-content/uploads/californias-tuition-policy-for-higher-education-september-2018.pdf.

Kolodner, Meredith and Sarah Butrymowicz. 2017. DEBT WITHOUT DEGREE: The human cost of college debt that becomes “purgatory”. The Hechingher Report. https://hechingerreport.org/debt-without-degree-the-human-cost-of-college-debt-that-becomes-purgatory/.

Larson, Richard, Navid Ghaffarzadegan, and Yi Xue. 2014. “Too Many PhD Graduates or Too Few Academic Job Openings: The Basic Reproductive Number R0 in Academia.” Systems Research & Behavioral Science 31, 6: 745-750.

Liu, Michelle Camacho. 2011. “Do For-Profit Schools Pass the Test? National Conference of State Legislatures. http://www.ncsl.org/research/education/do-for-profit-schools-pass-the-test.aspx.

Lochner, Lance and Enrico Moretti. 2004. “The Effect of Education on Crime: Evidence from Prison Inmates, Arrests, and Self-Reports.” American Review 94, 1: 155.

Lovenheim, Michael and Emily G. Owens. 2013. “Does Federal Financial Aid Affect College Enrollment? Evidence from Drug Offenders and the Higher Education Act of 1998.” Working Paper 18749.

Lucca, David O., Taylor Nadauld, and Karen Shen. 2017. “Credit Supply and the Rise in College Tuition: Evidence from the Expansion in Federal Student Aid Programs.” Federal Reserve Bank of New York, 733. https://www.newyorkfed.org/research/staff_reports/sr733.html.

McClure, Kevin R. and Kenneth Teitelbaum. 2016. “Leading Schools of Education in the Context of Academic Capitalism: Deans' Responses to State Policy Changes.” Policy Futures in Education 14, 6. doi: 10.1177/1478210316653690.

Mitchell, Michael and Michael Leachman. 2015. “Years of Cuts Threaten to Put College out of Reach for More Students.” Center on Budget and Policy Priorities. http://www.cbpp.org/research/state-budget-and-tax/years-of-cuts-threaten-to-put-college-out-of-reach-for-more-students.

Montalto, Catherine P., Erica L. Phillips, Anne McDaniel, and Amanda R. Baker. 2018. “College Student Financial Wellness: Student Loans and Beyond.” Journal of Family and Economic Issues. doi: https://doi.org/10.1007/s10834-018-9593-4.

Moody, Josh. 2018. “Are College Tuition Resets Catching On?.” Forbes. https://www.forbes.com/sites/joshmoody/2018/09/20/are-college-tuition-resets-catching-on/#bcb4b6d3a5da.

Moreau, Alexandre. 2018. “Higher Education: The True Cost of ‘Free’ Tuition.” Montreal Economic Institute. http://test.iedm.org/2018/08/16/83413-higher-education-true-cost-free-tuition/.

NACUBO, National Association of College and University Business Officers. 2016. 2015 NACUBO Tuition Discounting Study. Washington, DC: National Association of College and University Business Officers. http://products.nacubo.org/index.php/nacubo-research/2015-tuition-discounting-study.html.

NACUBO, National Association of College and University Business Officers. 2018. 2017 NACUBO Tuition Discounting Study. Washington, DC: National Association of College and University Business Officers. https://www.nacubo.org/News/2018/4/NACUBO-Releases-the-2017-NACUBO-Tuition-Discounting-Study.

Nova, Annie. “Federal student loans are about to get more expensive. What you need to know.” 2018. CNBC. https://www.cnbc.com/2018/05/10/student-loans-just-got-more-expensive-.html.

Oreopoulos, Philip and Uros Petronijevic. 2013. “Making College Worth It: A Review of Research on the Returns to Higher Education.” The National Bureau of Economic Research. http://www.nber.org/papers/w19053.

Payscale. 2018. PayScale 2018 College ROI Report Best Value Colleges. https://www.payscale.com/college-roi.

Rothstein, Jesse and Celia Elena Rouseb. 2011. “Constrained after college: Student loans and early-career occupational choices.” Journal of Public Economics 95, 1: 149-163. https://doi.org/10.1016/j.jpubeco.2010.09.015.

Schneider, Pat. 2015. "Deregulations of Tuition in Texas Could Provide Cautionary Tale for Wisconsin.” Madison Capital Times. https://search.proquest.com/docview/1655956620?accountid=35803.

Scott-Clayton, Judith. 2018. “The looming student loan default crisis is worse than we thought.” The Brookings Institute. https://www.brookings.edu/research/the-looming-student-loan-default-crisis-is-worse-than-we-thought/.

Sengenberger, Jimmy. 2017. “The Higher and Higher Cost of Higher Ed.” The Weekly Standard. https://www.weeklystandard.com/jimmy-sengenberger/the-higher-and-higher-cost-of-higher-ed-2008027.

Stanwod, Jenna. 2016. "Looking at the Effects of International Tuition Deregulation." University Wire. https://search.proquest.com/docview/1910355386?accountid=35803.

Stoddard, Christiana, Carly Urban, and Maximilian D. Schmeiser. 2018. "College Financing Choices and Academic Performance." The Journal of Consumer Affairs 52, 3: 540-561. doi: http://dx.doi.org/10.1111/joca.12175.

Student Borrower Protection Center. 2019. https://protectborrowers.org.

The College Board. 2019. “Total Federal and Nonfederal Loans over Time.” fhttps://trends.collegeboard.org/student-aid/figures-tables/total-federal-and-nonfederal-loans-over-time.

The College Board. 2018. Trends in Higher Education Series: Trends in College Pricing 2018, 3. https://trends.collegeboard.org/sites/default/files/2018-trends-in-college-pricing.pdf.

The Ohio State University, College of Education and Human Ecology. 2017. “Study on Collegiate Financial Wellness: 2017 Key Findings Report.” Page 32. https://cssl.osu.edu/posts/632320bc-704d-4eef-8bcb-87c83019f2e9/documents/2017-scfw-key-findings-report.pdf.

Tompor, Susan. 2017. “College grads seeking forgiveness need to watch rules -- and companies servicing their loans.” Detroit Free Press. https://www.freep.com/story/money/personal-finance/susan-tompor/2017/06/24/student-loan-forgiveness-cfpb-tips/416709001/.

United States, Library of Congress. 2017. “Primary Documents in American History: Morrill Act.” https://www.loc.gov/rr/program/bib/ourdocs/morrill.html.

United States Government Accountability Office. 2018. PUBLIC SERVICE LOAN FORGIVENESS: Education Needs to Provide Better Information for the Loan Servicer and Borrowers. https://www.gao.gov/assets/700/694304.pdf.

U.S. Department of Education. 2018. Student Aid Overview Fiscal Year 2019 Budget Request, N-1. https://www2.ed.gov/about/overview/budget/budget19/justifications/n-sao.pdf.

U.S. Senate Majority Committee Staff Report and Accompanying Minority Committee Staff View. 2012. For Profit Higher Education: The Failure to Safeguard the Federal Investment and Ensure Student Success.https://www.help.senate.gov/imo/media/for_profit_report/PartI-PartIII-SelectedAppendixes.pdf.

Usher, Alex. 2017. “The Emergence (and Perils) of Income-Targeted Free Tuition.” International Higher Education 91. https://ejournals.bc.edu/ojs/index.php/ihe/article/view/10128.

Valletta, Robert G. 2016. “Recent Flattening in the Higher Education Wage Premium: Polarization, Skill Downgrading, or Both?.” The National Bureau of Economic Research. http://www.nber.org/papers/w22935.

Vedder, Richard. 2018. “Tuition Resents and the Redistribution of Income,” Forbes. https://www.forbes.com/sites/richardvedder/2018/03/22/tuition-resets-and-the-redistribution-of-income/#553b67306ee1.

Voice of the graduate. McKinsey & Company, in collaboration with Chegg, May 2013, 6, 15. https://www.mckinsey.com/~/media/mckinsey/industries/social%20sector/our%20insights/voice%20of%20the%20graduate/voice_of_the_graduate.ashx .

White House Budget. 2017-18. “America First: A Budget Blueprint to Make America Great Again.” https://www.whitehouse.gov/sites/whitehouse.gov/files/omb/budget/fy2018/2018_blueprint.pdf.

Wilkins, Nicole. 2017. “State of financial aid: Financial-wellness programs benefit students at IU and beyond.” Indiana University. https://news.iu.edu/stories/2017/04/iu/inside/14-student-financial-aid.html.

Zimmerman, Seth D. 2019. “Elite Colleges and Upward Mobility to Top Jobs and Top Incomes.” American Economic Review 109, 1: 1–47. doi: https://doi.org/10.1257/aer.20171019.

Zinshteyn, Mikhail. 2016. Financial aid “arms war” continues to drain cash from colleges.” The Hechinger Report. https://hechingerreport.org/financial-aid-arms-war-continues-drain-cash-colleges/.